Phantom #2: how to grow 5x in a year?

How did Phantom grow 5x despite intense competition among self-custodial wallets?

This is Part 2 of our Phantom protocol review. Check out Part 1 to learn more about Phantom’s features, user experience, and security practices.

Self-custodial wallet is a competitive market – even Centralized Exchanges (CEX) like Coinbase and OKX are joining the race. Having reviewed Phantom’s features, user experience, and security practices in Part 1, we’re going to dig deeper into its user adoption and business model to see how Phantom becomes a top contender despite competition.

User acquisition

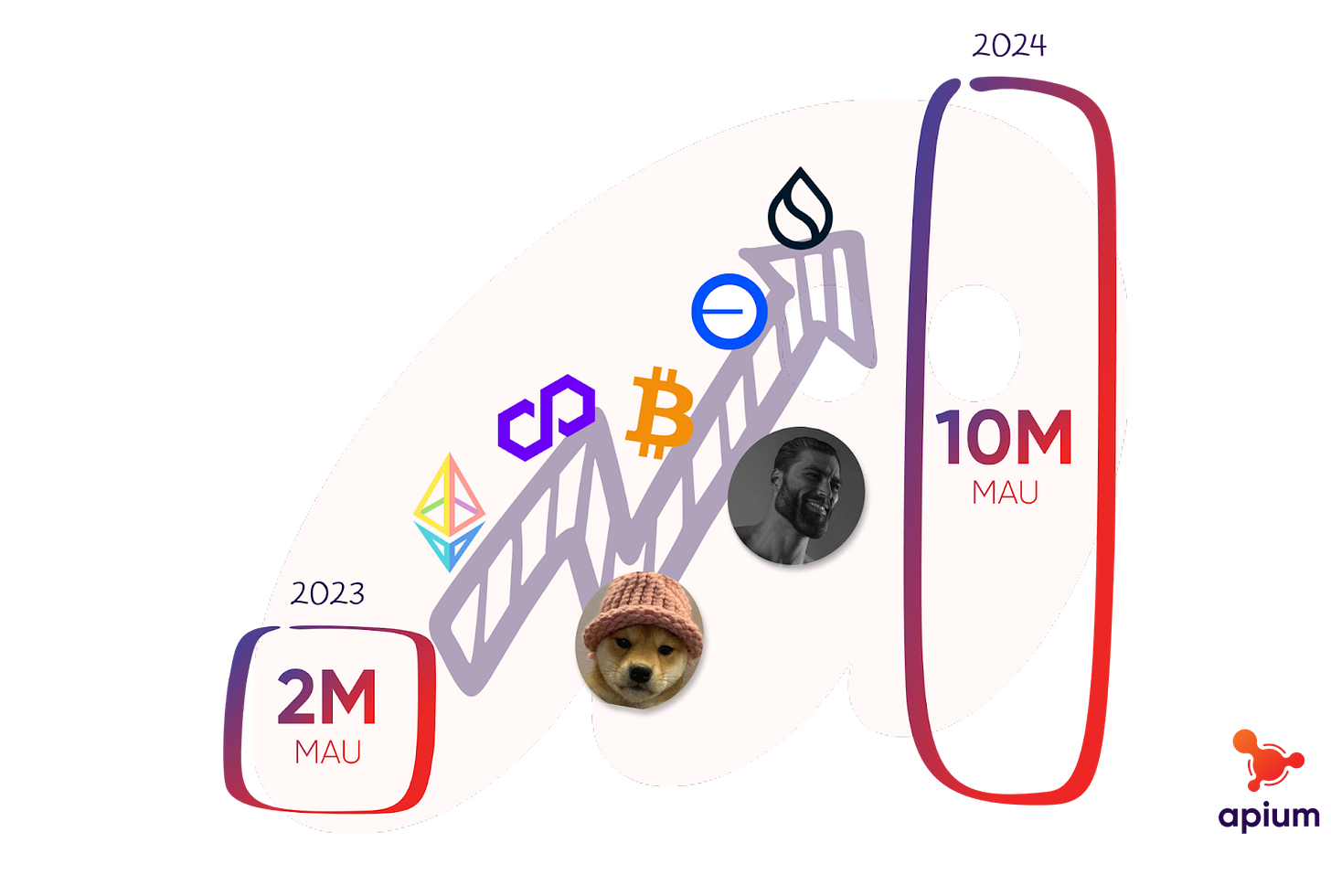

Phantom had a remarkable growth in 2024, reaching 10mn monthly active users (MAU) by year-end. This is a 5x increase when you compare that to their 2mn MAU by the end of 2023. A better macro market certainly helps, but what else did they do to grow so fast?

More chains, more users, more transactions. Originally started as a Solana-only wallet, Phantom expanded to integrate Ethereum and Polygon (2023), Bitcoin (May 2024), Base (Nov 2024) and Sui (Jan 2025). This helped Phantom acquire new users that ultimately conducted 850mn transactions in 2024 alone, a 5x jump from 2023, involving 788,000+ distinct tokens. Its mobile app also saw a cumulative 24mn downloads since it launched 3 years ago.

Memecoin boom led to higher self-custodial wallet adoption. While CEX continues to be a popular trading platform, getting listed there takes time – so memecoins, which typically have a short window of fame and hype, are often launched on Decentralized Exchanges (DEX). That drove users to self-custodial wallets to trade the hottest tokens. As Solana was home to the memecoin boom, Phantom seized the opportunity to rise to the top choice for memecoin traders. Integrating Base helped cater to traders as memecoins started to flourish there as well.

Not launching its own native token was probably Phantom’s intention to focus on utility over speculation. Instead of using a token launch and airdrop to drive adoption, Phantom builds quickly to acquire users through chain integrations to partnerships. That not only helps the team focus on product development with less distraction at a crucial growth period, but also ensures users acquired are drawn to its features rather than tokenomics.

Business model

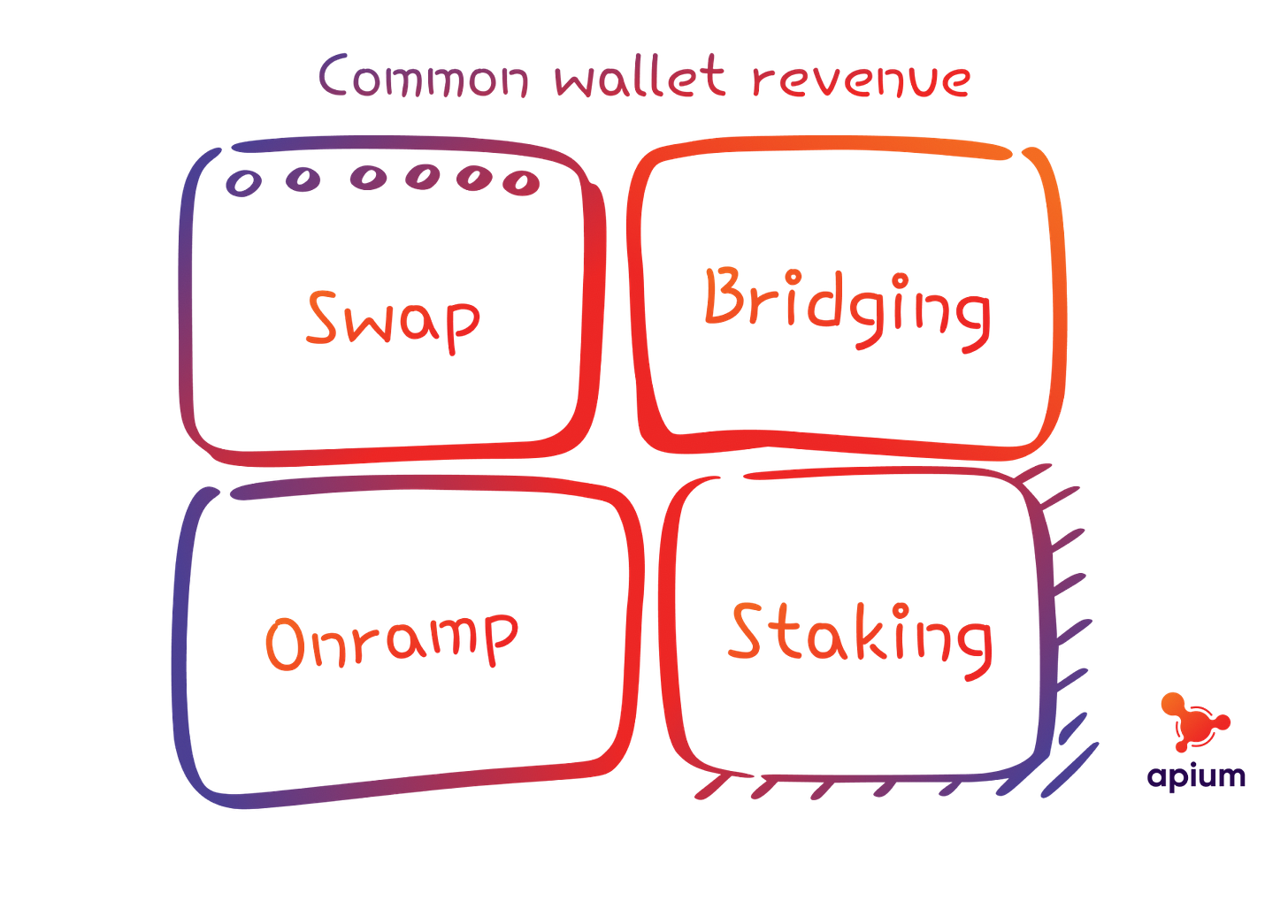

Phantom has developed a diverse revenue model. Its core revenue streams, similar to other wallets, include swap fees, staking services, fiat onramps, and cross-chain bridging solutions. But it also started strategic acquisitions in 2024 which might bring on additional revenue. Let’s take a closer look.

Core revenue streams

Swap Fees: Phantom charges a 0.85% service fee per swap, keeping it competitive with wallets like MetaMask (0.875%).

Staking Services: While Phantom doesn’t take a cut from Solana (SOL) staking rewards, it enhances user retention and strengthens the ecosystem. There might be potential referral revenue here but we cannot confirm at this time.

Fiat Onramps: Partnerships with MoonPay, Ramp, Meld, and Transak allow users to buy crypto with fiat, earning Phantom a share of transaction fees.

Cross-chain bridging: Integrations with Li.Fi, 0x, Jupiter, Allbridge, and Mayan Finance facilitate seamless cross-chain asset transfers, which not only enhances user experience as Phantom goes multi-chain but also becomes a potential source of referral revenue.

Strategic acquisition

Phantom acquired Bitski (NFT infrastructure) and Blowfish (security solutions) in 2024. This helps enrich their features, but also signal a shift toward B2B services that opens up new revenue streams.

Bitski provides an integrated NFT marketplace, minting tools, and enterprise NFT solutions. This drives revenue growth through transaction fees, subscriptions, and even platform fees for enterprises launching their own NFT collections (e.g., Adidas).

Blowfish offers wallet security features that Phantom has adopted before acquisition. It also creates revenue opportunities from other wallet competitors that require its security services and compliance tooling.

Other revenue opportunities

Premium Features: Phantom could either earn referral fees when its users register for analytics platforms like Arkham, or even build those features in-house as add-on services for users. The decision would likely be driven by the development lift vs user demand. For now, we think it’s wise to partner with third parties to test the market.

Institutional Wallet: Metamask first announced its institutional offering in late 2021 as Fireblocks proved that institutions are interested to hold digital assets on their books. But the viability of this market depends on user readiness – do they want a non-custodial solution? As we start seeing enterprises getting more comfortable with Bitcoin, we may see a rise of that opportunity.

Token Launcher: Taking a page from the CEX playbook, we know retail users are interested in tapping into new tokens. New projects would love to tap into Phantom’s vast user base and are most likely happy to pay for it. However, Phantom might want to consider if that compromises user experience for those less interested in token launches – or if their users would turn against them if those tokens flop.

User Retention

In a market where you can easily switch to another wallet through importing your seed phrase, user retention is key to survive. After all, Phantom makes money when you transact with their platform, not when you first register. So how could Phantom get you to stay?

Satisfying user needs through useful features and great UX are the most important. Security is key to not losing hard-earned users. We have elaborated on that in Part 1 – do take a look and let us know if there are more features you wish Phantom has.

Gamification might be another way to go. As more dApps and wallets started to realize, incentivizing users to log on regularly (e.g., earn points if you maintain a daily check-in streak) could help. We have seen this practice in Trust Wallet and Coingecko. But there is always a fine line to toe – while gamification can boost engagement, it risks fostering superficial interactions and user fatigue if not carefully implemented.

The self-custodial model emphasizes flexibility, making brand loyalty harder to sustain. Brand recognition, UX, and security are key differentiators, but Web3 products need to keep innovating for long-term success as the traditional moats are absent.

What’s next for Phantom?

Phantom’s Series C funding signals its expansion into social discovery and peer-to-peer (P2P) payments, leveraging its 3.8M usernames to enhance user engagement and financial transactions in Web3.

While Web2 platforms (Facebook, Instagram, Twitter) dominate social discovery, Web3 alternatives like Farcaster and Lens Protocol offer decentralized and user-controlled interactions.

Does that mean Phantom will create a payment-based social graph like Venmo in 2025? We don’t know. All that we could know for certain is that Phantom is actively exploring new ways for users to use its wallet, while expanding to the B2B market with its acquisitions.

Next up: can Phantom sustain its 5x growth in the years to come? Check out the final part of our Phantom series here ↓

Phantom #3: Finding another 5x growth

This is Part 3 of our Phantom protocol review series. Part 1 elaborates on its features, user experience, and security practices while Part 2 speaks to its adoption and business model.